2018 points roundup

The chaotic holiday season is finally behind us, and I'm sitting here really enjoying this second cup of coffee and the very quiet house. Looking back on 2018 from a points perspective, I had another good year of earning – 493,000 points (I'm not including my husband's earning since his employer pays for a bunch of his travel).

Breaking that down a bit:

I might churn an Alaska Airlines visa or maybe I'll finally take the plunge and get a Citi American Airlines card. My husband got a rose gold Amex card (with its awesome 4x on dining) and I'm an authorized user on his account so I'm fairly certain one of us will end up canceling our Chase Sapphire Reserve card. The trip protection insurance is one of its big selling points but I've heard nothing but bad news from people who've actually tried to use it.

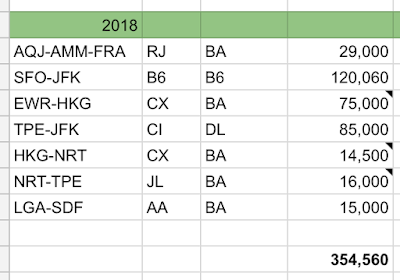

Given that I'm always talking about the "earn and burn" mantra, I'll mention here that I spent 354,000 points in 2018 (for myself – again, not including points I spent on my husband).

United "Mile Play" game – 300 bonus miles for using their MileagePlusX app

Amex offer – spend $50 at Amazon get 2,000 bonus miles

Amex offer – spend $250 at Farfetch, get 5,000 bonus miles (used that on 2 cards, so 10,000)

Amex offer – spend $75 at Boxed.com, get 2,000 bonus miles (used that on 2 cards, so 4,000)

Q2

Amex Platinum upgrade 60k

Chase Business Ink in-branch 100k

Caviar Amex offer 1000

Amex offer 1500 points for $150 at Macy's

United shopping portal spring bonus 300 miles for $150

Retention offer on my Business Amex – 5,000 points + 15,000 more if I spend $10k in 3 months

Q3

Martha Stewart wines offer 2,000

Wayfair offer 1,500

Amazon offer bonus 1,000

Q4

Amex Offer from AT&T 15,000

Embassy Suites Amex offer 5,000

Two referrals from Reddit 30,000

Breaking that down a bit:

- 51,000 miles with 4 airlines from paid flights and airline shopping portals

- 247,000 Amex points from spending and bonuses (of that: 30k from refer-a-friend, 60k from upgrading to the Platinum card, 42,000 from Amex Offers, the rest from spending)

- 95,000 Chase points from credit card spending (85k of those were in travel and dining)

- 100,000 Chase points for doing an in-branch offer for a new Ink Business card

I might churn an Alaska Airlines visa or maybe I'll finally take the plunge and get a Citi American Airlines card. My husband got a rose gold Amex card (with its awesome 4x on dining) and I'm an authorized user on his account so I'm fairly certain one of us will end up canceling our Chase Sapphire Reserve card. The trip protection insurance is one of its big selling points but I've heard nothing but bad news from people who've actually tried to use it.

Given that I'm always talking about the "earn and burn" mantra, I'll mention here that I spent 354,000 points in 2018 (for myself – again, not including points I spent on my husband).

|

| Decided to burn some of those JetBlue points since their European routes still haven't been announced... |

A few random earning highlights

Q1United "Mile Play" game – 300 bonus miles for using their MileagePlusX app

Amex offer – spend $50 at Amazon get 2,000 bonus miles

Amex offer – spend $250 at Farfetch, get 5,000 bonus miles (used that on 2 cards, so 10,000)

Amex offer – spend $75 at Boxed.com, get 2,000 bonus miles (used that on 2 cards, so 4,000)

Q2

Amex Platinum upgrade 60k

Chase Business Ink in-branch 100k

Caviar Amex offer 1000

Amex offer 1500 points for $150 at Macy's

United shopping portal spring bonus 300 miles for $150

Retention offer on my Business Amex – 5,000 points + 15,000 more if I spend $10k in 3 months

Q3

Martha Stewart wines offer 2,000

Wayfair offer 1,500

Amazon offer bonus 1,000

Q4

Amex Offer from AT&T 15,000

Embassy Suites Amex offer 5,000

Two referrals from Reddit 30,000

Comments

Post a Comment